Pay and Get Paid Faster When You Use Payco for Letters of Credit

We provide the fastest, easiest way to get fully compliant letters of credit for trade confirmation. We’re also the cheapest.

Discuss your trade finance needs with us directly

Get Started

How it Works

Letters of Credit for International Trade Finance in Minutes… for Everyone

Don’t use banks for letters of credit. Get instant, cheap letters of credit from Payco instead.

Trade with Payco: The Future of Letters of Credit

Letters of credit (LCs) are used routinely in international trade. They are financial instruments that guarantee payment to an exporter for the delivery of goods or services LCs have been used for a long time, but we’re revolutionizing the way they work using technology. At the moment, LCs are provided by banks that operate through slow, expensive and complicated systems. Bank LCs take several days to process, they cost as much as 3x the cost of a Payco LC, and they’re a hassle but now you don’t need to wait so long and pay so much. We’ve changed the way LCs work using blockchain technology, artificial intelligence and stable cryptocurrencies. Letters of credit are now much faster, cheaper and easier with Payco. We’ve opened up the eligibility requirements as well, making LCs available to all businesses.

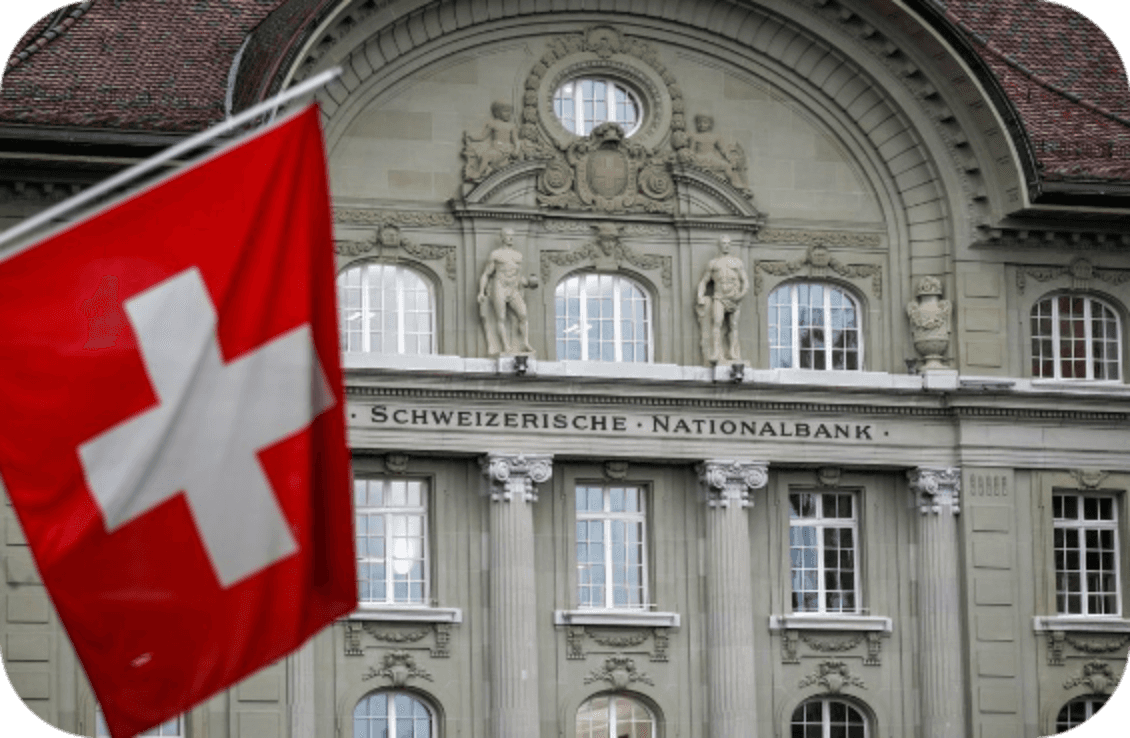

We’re a Fully Regulated Swiss Financial Intermediary

Payco is a registered financial intermediary in Switzerland. We operate under the supervision of the same regulators that regulate Swiss banks Payco is fully regulated by Swiss authorities - We are a VQF SRO member, and we comply with all the Swiss regulations regarding the financial intermediary license limits payco letters of credit are fully compliant with UCP600 – This is the set of rules from the International Chamber of Commerce that applies to financial institutions that issue letters of credit protection through international law - Letters of credit issued by Payco follow legally binding trade agreements that protect the rights of the buyer and the seller.

What Do You Get With Payco?

Faster processing than with a bank

Lower fees than

anywhere else

No need for third-party confirmation

Importer applies for a letter of credit

With our simple online wizard, importers can create a UCP600-compliant LC in less than 10 minutes. To make things really easy, Payco integrates with your accounting software, so you can use existing invoices to create new LCs.

10 mins - Time to create a Payco LC

2 - 4 days - Time to create a traditional LC

Payco sends letter of credit to exporter

After an importer obtains a letter of credit, we send it directly to the exporter. This allows an order to be fulfilled as quickly as possible.

Our system is far more efficient than bank systems, which saves money. Here’s how our fees stack up against bank fees.

3 - 5% - Payco LC fee

10 - 12% - Average traditional LC fee

Exporter delivers goods and presents documents to Payco

Exporters can upload the required documents at any time and from any location for AI-assisted review and to receive payment.

5 mins - Time with a Payco LC

1 - 2 days - Time with a traditional LC

Buyer confirms receipt of goods and Payco transfers payment to the exporter

Once Payco accepts the documents, the LC payment is transferred to the exporter. Using stable cryptocurrencies allows us to deliver much faster settlement times than traditional LCs.

1 min - Time to receive stablecoins

2 - 4 days - Time to receive wire transfer

Here’s How Payco LCs Work…

The Payco system is backward compatible with the SWIFT network

We can also get you started on our system quicker than banks.

Welcome On Payco

You can be on our system in 5 minutes instead of 3-5 business days.

We’re Revolutionizing Letters of Credit With Technology

Payco provides letters of credit for trade confirmation

Blockchain technology

Document handling is more secure and more efficient

Artificial intelligence

Document processing and review takes seconds rather than days

Stable Cryptocurrencies

Transactions are executed quickly and securely

Why You Should Switch to Payco for Letters of Credit

Businesses that use bank LC systems regularly and are tired of the delays, hassle and cost that come with them will see a big improvement with Payco. Our system makes paying and getting paid in international trade with letters of credit easier, faster and cheaper than with the old methods.

We also open up more possibilities and improve the security of LC transactions.

More Trade Finance Possibilties

We provide letters of credit for values under $100,000. Banks often don’t. This opens up letters of credit to businesses executing transactions at lower values. Similarly, we also provide a solution in geographical regions where poor bank credit ratings or other issues make LCs difficult to obtain.

Enhanced Transaction Security

With the Payco LC system, you get a better level of security for every transaction than you do with a bank LC.

This is because the compliance requirements for our financial intermediary license require us to operate with a full reserve. Banks, on the other hand, often operate with a fractional reserve. We also don’t take customer funds off our balance sheet by reinvesting them.

All our LC products are fully funded, making fund delivery guaranteed.

Payco Works Like an Escrow Service

After an importer takes out an LC, we hold their funds in a secure escrow account. Upon completion of an exchange, the funds are then released to the exporter. Both parties can have complete trust in each other and the system they rely on.

Make your transactions safely with Payco!

Home

About Us

Products

Contact Us

How it works

FAQs

Blog

Payco is a digital solution for cross-border payments, providing secure and convenient services for individuals and businesses. With Payco, you can easily send money internationally, issue letters of credit, and conduct transactions using our secure digital wallet.

Catch us on